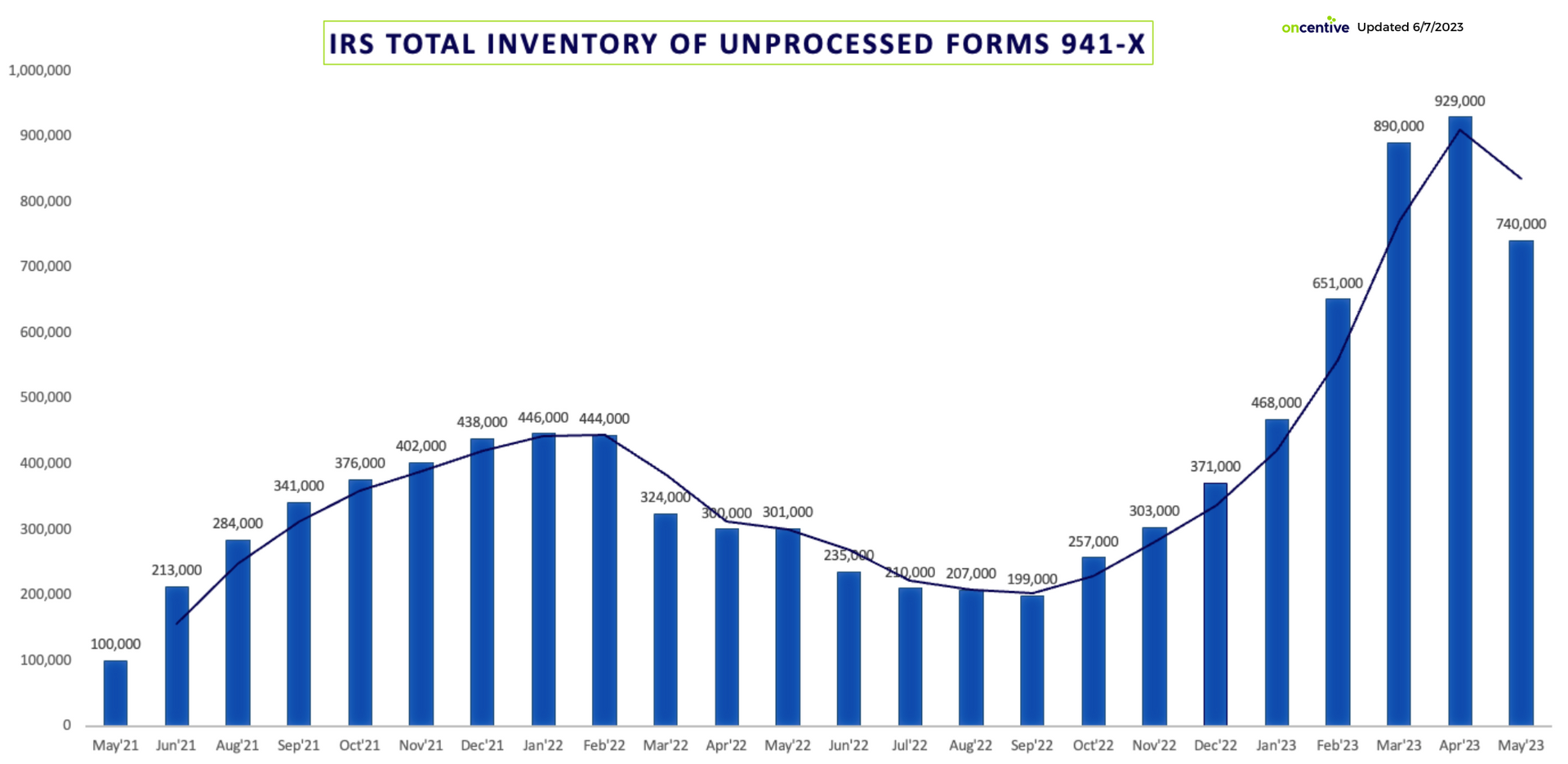

June 2023 ERC Claims Update: Progress Made on IRS Backlog of Unprocessed 941-X Forms

As of May 31, 2023, the Internal Revenue Service (IRS) revealed a backlog of approximately 740,000 unprocessed Form 941-Xs (Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund). This form serves as a lifeline for the many employers that were impacted by the COVID-19 crisis, allowing them to claim critical tax credits such as the Employee Retention Tax Credit (ERC). Although this number signifies a downward trend from nearly one million unprocessed forms in April, many business owners still find themselves entangled in the frustrating web of IRS delays to receive their much-needed pandemic relief funds.

Further compounding this situation is the existing backlog of unprocessed Forms 941. As of June 1, 2023, the IRS is grappling with

2.0 million unprocessed Forms 941 (Employer’s Quarterly Federal Tax Return), impeding the processing of related 941-Xs.

In a recent video press conference, Senator Kirsten Gillibrand (D-NY) demanded the IRS to address the escalating backlog of unprocessed employment tax forms. Her advocacy stems from the distress calls she has been receiving from businesses in her state, waiting anxiously for their ERC tax refunds for claims filed in March 2021 for wages paid in 2020.

Senator Gillibrand emphatically

stated, “At the height of the pandemic, thousands of small businesses did the right thing and kept their employees on payroll. They were promised reimbursement, but years after the fact, they still haven’t received it. I am calling on the IRS to speed up its processing to fix this problem as soon as possible and get our hard-working small business owners the refunds they deserve.”

Taking a further step, Gillibrand penned a

letter to IRS Commissioner Daniel Werfel, requesting a detailed state by state breakdown of the current ERC backlog and the agency's plans and timeline to resolve this pressing issue.

Although IRS Commissioner Daniel Werfel did not directly respond to Gillibrand’s letter as of June 7, 2023, he voiced his concerns regarding the backlog during an

April 27, 2023 Ways and Means Committee hearing. Werfel disclosed that during the filing season, the IRS managed to process about 20,000 ERC credit claims per week. However, with the filing season at its end, he reassured that the IRS was primed to recalibrate staffing and expected to more than double the processing rate to 40,000 to 50,000 processed claims per week. The Commissioner assured the Committee that addressing the unprocessed 941-Xs was a top priority, and they were actively seeking solutions to improve efficiency and set more aggressive targets to manage the backlog.

The IRS has outlined a

10-year funding plan focused on increasing digitization, which includes the scanning of forms like the Form 941 to streamline processing. As of June 2023, the Form 941-X must be filed in paper format. It remains uncertain whether future IRS funding initiatives will incorporate an electronic filing option for Form 941-X.

The prolonged delays in processing ERC claims pose significant challenges for eligible employers who depend on these refunds for their financial stability. The waiting period, characterized by months of uncertainty and lack of clear communication from the IRS, is incredibly frustrating.

To provide some relief,

OnCentive, a seasoned profitability consultant, has teamed up with several financial institutions to launch a unique

funding program. This innovative solution circumvents the typical eight to nine-month wait from the IRS and provides a swift cash infusion to clients within weeks.

For further details on OnCentive’s funding program, visit

https://www.oncentive.com/covid-19-erc-funding.

The urgency to address the delays in processing ERC claims cannot be overstated. Employers eligible for these refunds need them promptly to effectively manage their financial strategies and maintain business operations. It is crucial for the IRS to clarify the reasons behind these delays and provide a timeline for resolving the backlog. Meanwhile, solutions like

OnCentive's funding program offer a practical stop-gap, helping businesses weather this challenging period.

Have Questions or Need More Information?

<script type=" text=""/>

<script type=" text=""/>