Update on IRS’s Backlog of Unprocessed ERC Claims

On March 23, 2023, a group of fifteen Republican members of the House Ways and Means Committee sent a letter to the new IRS Commissioner, Daniel Werfel, expressing their concern about the chronic delays in processing employee retention tax credit (ERC) claims. This letter requested information on various aspects of the delay and its impacts on businesses, but as of April 12, 2023, the meeting with the IRS has yet to occur.

Since late 2021, the only available method for filing an ERC claim with the IRS has been via

Form 941-X, the Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. Unfortunately, this form can only be filed through mailing or faxing, and there is no option for filing electronically. This means that the IRS must manually review each form after processing the original Forms 941.

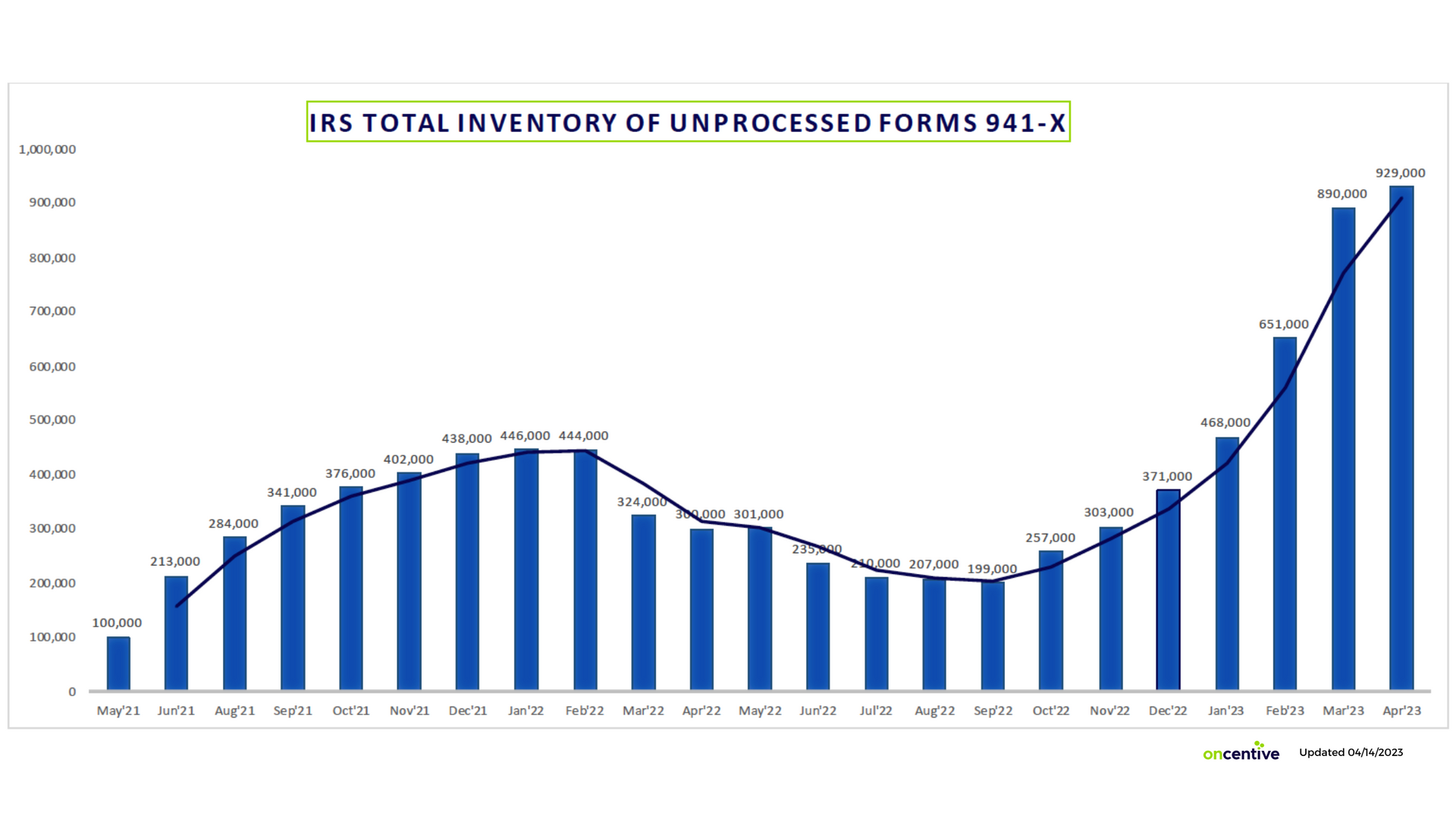

The backlog of unprocessed ERC claims has been

growing since the fall of 2022, and as of

April 5, 2023, the IRS has a backlog of approximately 929,000 unprocessed Forms 941-X. The reason for this rapid increase is uncertain, but the

IRS website indicates that trained staff at two sites (Cincinnati and Ogden) are working on the inventory of Forms 941-X.

The delay in processing ERC claims is a significant concern for eligible employers who rely on these refunds to help with their finances. It is frustrating to wait for months without any communication from the IRS on when to expect the funds. As a true profitability consultant, OnCentive understands this frustration and has developed a funding program in partnership with several financial institutions. This program bypasses the typical eight to nine-month wait from the IRS and provides immediate cash infusion to clients within weeks.

For more information on OnCentive’s funding program, please visit https://www.oncentive.com/covid-19-erc-funding.

The delay in processing ERC claims is a significant issue that needs to be addressed promptly. Eligible employers require timely refunds to help them navigate their finances and maintain their operations. The IRS needs to provide clarity on the reasons for the delay and a timeline for resolving the backlog.

In the meantime, solutions such as OnCentive's funding program can help ease the burden for businesses affected by the delay.

Have Questions or Need More Information?

<script type=" text=""/>

<script type=" text=""/>