Increasing Staffing Companies' Profitability with Tax Credits

Turn your HR functions of hiring and retaining employees into a profit center through tax credits and incentives.

Schedule a free tax credit eligibility assessment!

Start integrating tax credits and incentives in your staffing firm's HR processes.

Contact us

Staffing Firms Can Qualify for the Employee Retention Credit

Many businesses, including staffing firms, are unaware or are misinformed about their eligibility for the Employee Retention Tax Credit (ERC). Made available through the CARES Act, Congress created ERC to provide financial relief to employers who retained employees during the Covid-19 pandemic.

If your staffing firm is deemed eligible, it could

receive up to $26,000 per W-2 employee. As a payroll tax credit, ERC can act as a cash infusion to your bottom line allowing you to reinvest in your people and your business.

Hiring InCentives: Turn Your HR Into a Profit Center

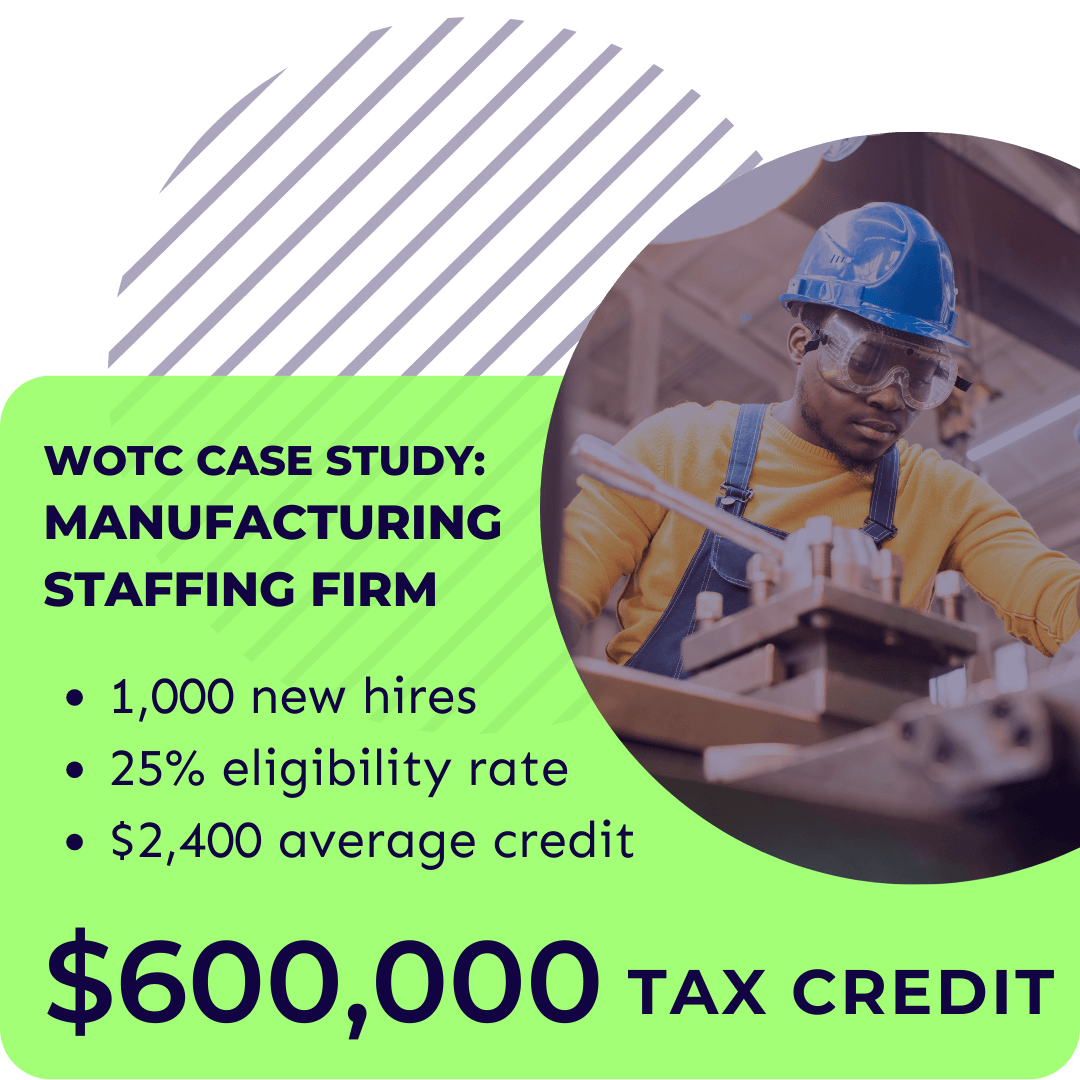

WORK OPPORTUNITY TAX CREDIT

$9,600

maximum credit amount

20%

average amount of eligible new hires

How OnCentive Helps You Leverage WOTC To Increase Profitability

OnCentive team makes capturing these WOTC credits simple and convenient.

We verify every new hire for eligibility. Our team manages collecting the proper documentation and follow up information from your employees.

OnCentive tailors our process to integrate with your current hiring processes and systems.

HR departments love OnCentive because of our customized approach to WOTC integration. Our WOTC experts work with your internal team to fit within your current processes.

OnCentive helps you receive the maximum credit available by increasing compliance.

OnCentive’s technology integrates directly within the states' WOTC departments. This ensures a higher compliance and faster turnaround time for your credits getting certified.

Schedule a call with an OnCentive Expert

Don’t Disqualify Yourself. Our Experts Determine Your Eligibility For Free.

Talk to one of our tax credit experts to determine how to best increase your staffing firm's profitability.

$3 BILLION

in tax credits claimed for clients

$0

returned to the IRS

100%

fees based on success fees

<script type=" text=""/>

<script type=" text=""/>