Colorado Enterprise Zone Credit

Receive a Tax Credit up to $2,000 per Eligible New Employee

Receive a Free

Eligibility Assessment

ERC ASSESSMENT

OnCentive can offer guidance and streamline the capturing of the Colorado Enterprise Zone Credit.

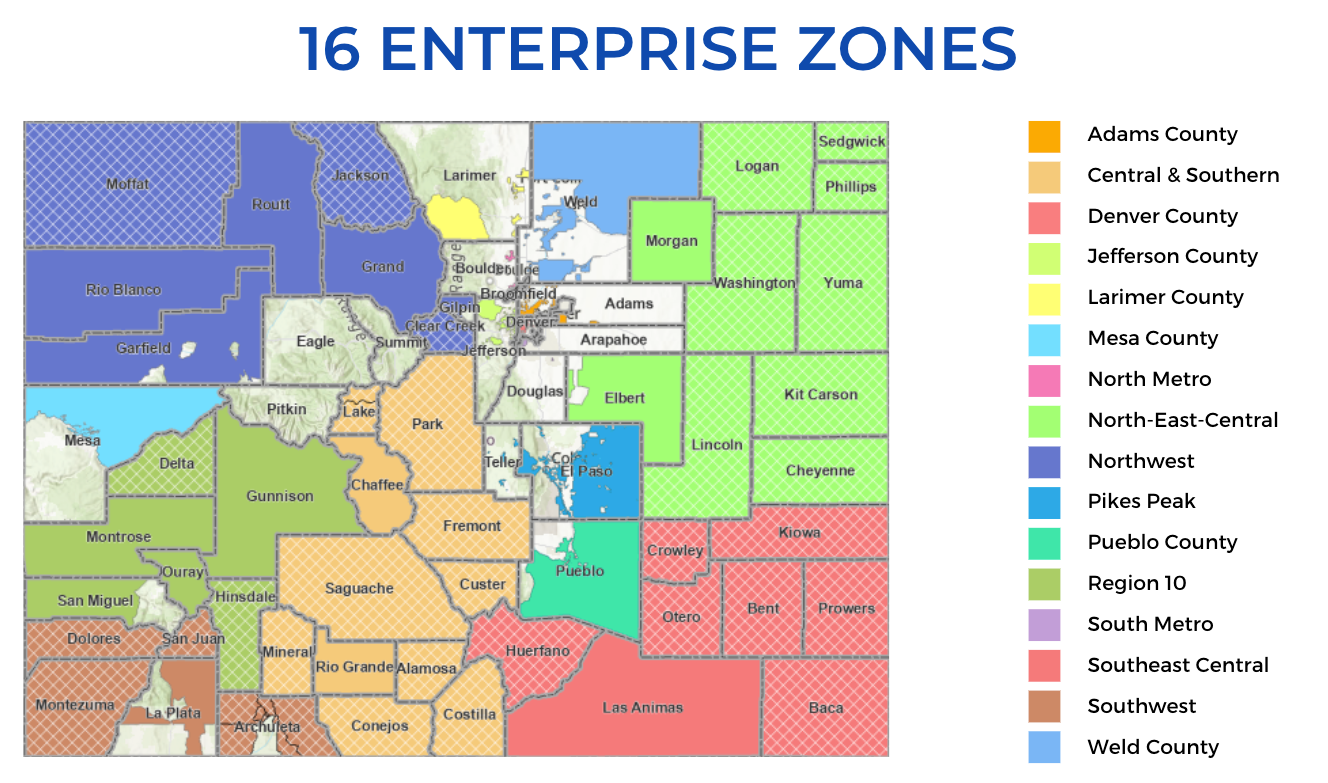

The state of Colorado designated 16 enterprise zones as areas with high unemployment rates, low per capita income, or slow population growth. Employers that establish a new facility or expand an existing facility in an enterprise zone may be eligible for several income tax credits.

Don't miss out on the opportunity to grow your business, create jobs, and contribute to Colorado's thriving economy. Discover more about the Colorado Enterprise Zone Credit and learn how OnCentive can help your business capture these credits by filling out the form.

$1,100

ENTERPRISE ZONE

MAXIMUM CREDIT PER ELIGIBLE EMPLOYEE

$2,000

ENHANCED RURAL EZ

MAXIMUM CREDIT PER ELIGIBLE EMPLOYEE

Discover the qualifications for the Colorado Enterprise Zone Credit

This program requires a pre-certification for each business location in advance of the activity that is eligible for the credit. The enterprise zone program includes credits for creating new jobs, provides qualified job training, and capital investments of qualified property used solely and exclusively in an enterprise zone. There is an additional program for providing health care coverage to employees, and credits specific to the agriculture industry.

Location(s) must be certified by the state and be located within an enterprise zone. Employees must work a minimum of 20 hours per week in the certified enterprise zone location(s). Maximum benefits: 3% of qualified investments, 12% of qualified training.

Meet Our Tax Credit & Financial Experts

Shannon Scott

CEO & Cofounder

Chris Smith, CPA

President

Frank Brown, J.D., LL.M.

Chief Incentive Officer & Cofounder

Garrett Gregory, Esq., LL.M.

Special Counsel for Tax Compliance

Joshua Hole, CPA, MT

President of Special Incentives

Roger Boatner, CPA

Partner

Not Sure If You Qualify?

Our Experts Determine Your Eligibility For Free.

We understand that evaluating the Colorado Enterprise Zone Credit may feel daunting. The important thing to remember is that you won’t be alone. OnCentive tax credit experts will be there with you every step of the way, to walk you through the process and help you prepare all the necessary documentation.

A 15-minute call can greatly benefit your business's bottomline.

<script type=" text=""/>

<script type=" text=""/>