Maximize Your COVID-19

Employee Retention Tax Credit

ERC can be worth up to $26,000 per W-2 employee

retained during the pandemic.

Receive a Free ERC

Eligibility Assessment

ERC ASSESSMENT

The Employee Retention Tax Credit (ERC) is a refundable tax credit that encourages businesses to keep employees on their payroll.

It’s worth up to $5,000 per employee in 2020 and up to $7,000 per employee per quarter (for the first three quarters) in 2021, for a max credit of $26,000 per employee.

Thousands of hard-working business owners trust OnCentive experts to maximize their Employee Retention Credit because:

- 100+ years of combined tax experience

- No upfront financial risk

- Sleep at night audit protection

- Fees are 100% success based

- Fast Funding option through trusted OnCentive partner

Fast Funding

Through our trusted funding partner, you can receive your ERC in weeks versus waiting months on the IRS.

Pay When You Get Paid

OnCentive works on success-based fees which means you pay only once you receive your credits.

Full Service Processing

With our platform, you’ll save time when you most need it, while serving your customers.

Meet Our Tax Credit & Financial Experts

Shannon Scott

CEO & Cofounder

Chris Smith, CPA

President

Frank Brown, J.D., LL.M.

Chief Incentive Officer & Cofounder

Garrett Gregory, Esq., LL.M.

Special Counsel for Tax Compliance

Joshua Hole, CPA, MT

President of Special Incentives

Roger Boatner, CPA

Partner

1000+

ERC CLIENTS

$1 Billion+

IN ERC CREDIT

100%

AUDIT SUPPORT

Start Your ERC Refund in 30 Minutes.

Impact Questionnaire & Document Collection

Our support team is here to ensure everything runs smoothly, so you can focus elsewhere.

File 941x & Receive Quick ERC Funding

With quick and accurate responses to all your queries, you’ll save time and be more efficient.

DOWNLOAD NOW:

Everything You Need To Know About The COVID-19 Employee Retention Tax Credit

ERC eBook

Download the FREE ERC eBook!

ERC Facts & Figures

Filing your ERC Claim with OnCentive just got even easier!

OnCentive's newly-launched ERC Connect platform offers clients increased visibility, flexibility and convenience.

With ERC Connect you can:

- Upload payroll & needed documentation within the dashboard.

- Complete the Impact Questionnaire in multiple sessions. All your answers are saved.

- Respond to requests from our operations team (no more getting lost in your inbox!)

- Easily add contributors from your company to help you fill out the Impact Questionnaire or upload documentation

- Track the progress of your business' eligibility through our process

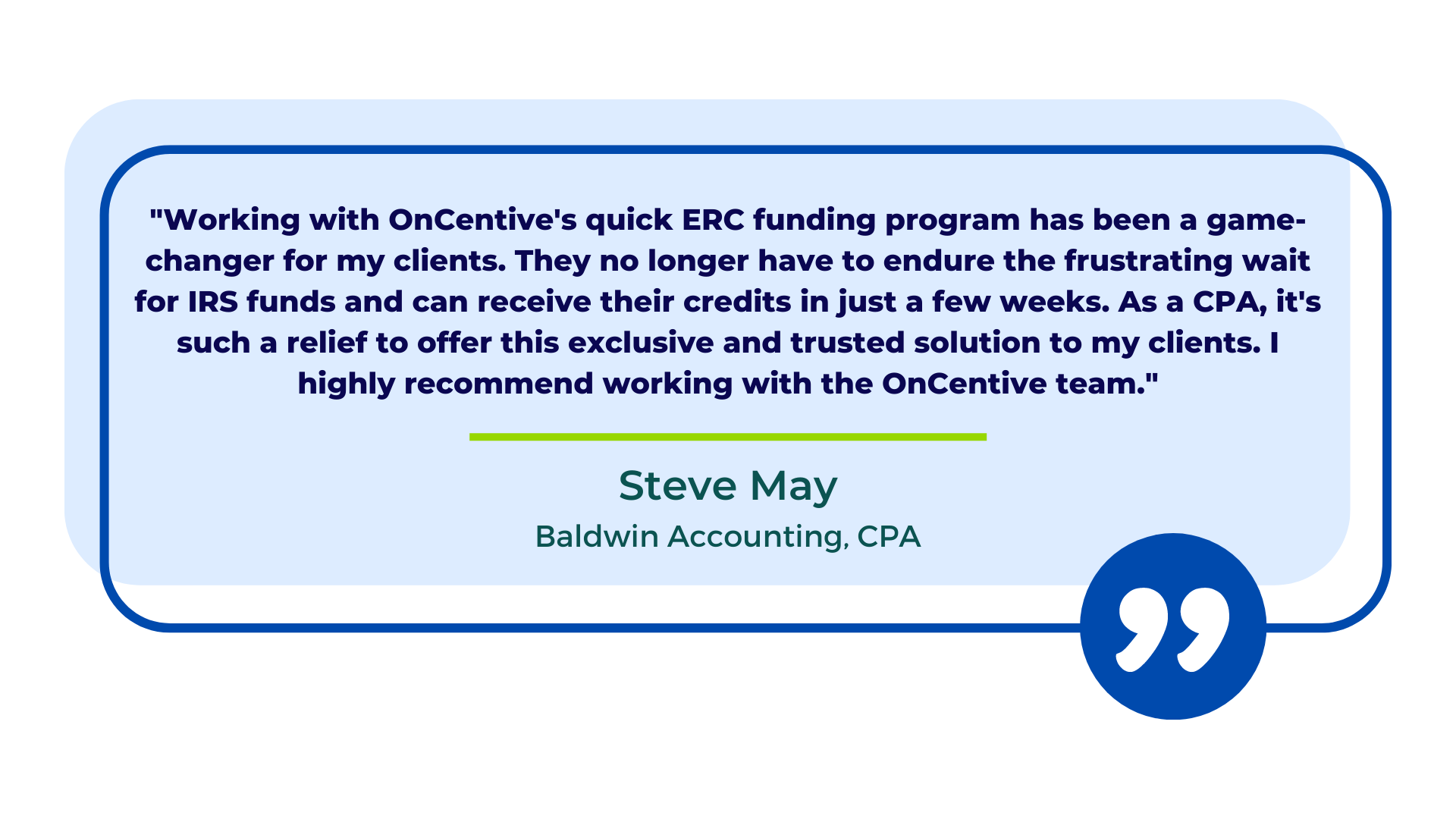

Accelerate Your ERC Refunds with OnCentive's Funding Program

Receive your ERC in WEEKS versus waiting months on the IRS.

If you're a business owner, you know how frustrating it can be to wait for the IRS to release your funds. We understand your struggles, and that's why we're thrilled to introduce you to our solution that promises quick results and puts cash in your hands within weeks.

At OnCentive, we're dedicated to providing a fast and reliable solution to the long wait for your Covid-19 Employee Retention Tax Credits. Thanks to our network of trusted funding partners, we can offer you funding within just a few weeks - bypassing the typical eight to nine-month wait from the IRS.

Schedule a call with an OnCentive Expert

Don’t Disqualify Yourself. Our Experts Determine Your Eligibility For Free.

Despite its meaningful impact, only 1% of qualified employers have filed

for ERTC in 2020 and only 3% in 2021.

<script type=" text=""/>

<script type=" text=""/>