Cannabis Business Can Qualify COVID-19 Employment Retention Credit

To aid the many businesses facing economic hardship caused by the global pandemic, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) provided relief, with two recovery programs: the Paycheck Protection Program (PPP), and the Employee Retention Tax Credit (ERC).

Cannabis businesses were not allowed to participate in the Paycheck Protection Program. Citing IRC Section 280E, the SBA stated that cannabis businesses were disallowed from participating in PPP. IRC Section 280E denies cannabis businesses from deducting otherwise ordinary business expenses from gross income for income tax purposes. However, this doesn’t mean cannabis businesses are disqualified from all recovery programs.

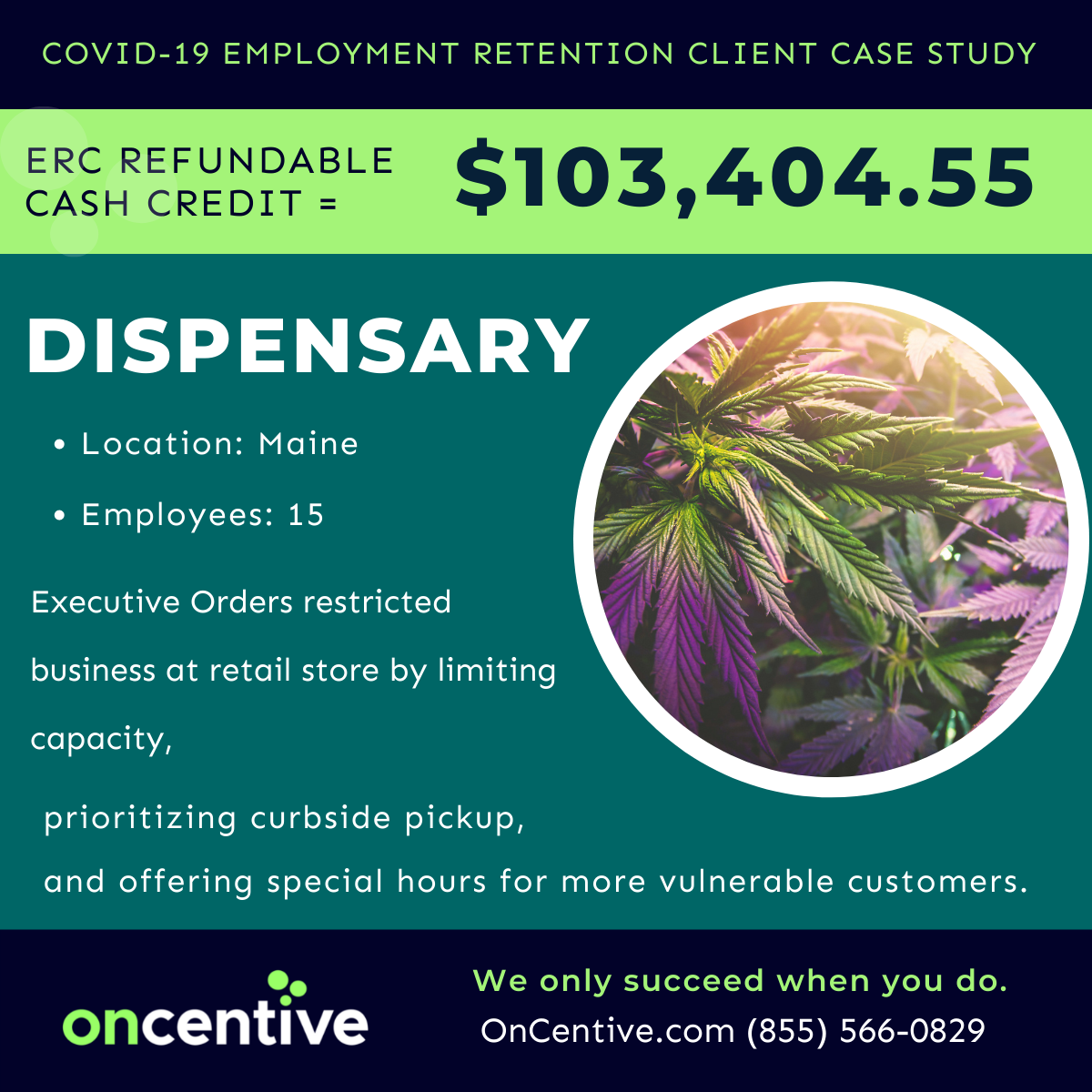

Cannabis businesses can qualify for the COVID-19 Employment Retention Credit, as it is classified as a payroll tax credit, and not an income tax credit. ERC is a refundable tax credit to businesses that retained employees during the pandemic who meet certain qualifications like forced closed closures, a decline in gross receipts from prior years, and other business interruptions. The credit is worth a maximum of $26,000 per w-2 employee.

Is it safe for my cannabis business to apply for ERC?

As a cannabis business, we know anything to do with taxes and federal regulation can be anxiety-inducing, to say the least. You need a partner with credit expertise within the cannabis industry: OnCentive has helped dispensary clients claim hundreds of thousands of dollars in Employment Retention Credit.

Led by the premier tax credit experts in the country, OnCentive offers clients 100% audit protection. In the unlikely event that a credit is contested, OnCentive will defend its work and fully refund any credits disallowed. Their team of tax lawyers and CPAs has over 100 years of combined tax credit experience. With over 1.5 billion in captured credits and $0 returned to the IRS, you can rest easy knowing you and your business are in good hands.

How Can My Cannabis Business apply for ERC?

OnCentive

makes it simple for business owners to qualify for the Employment Retention Credit. Unlike competitors and CPAs, OnCentive has no upfront cost or fees and waits for you to receive your check from the IRS to invoice their success fees. Simply put, OnCentive doesn't get paid until you do.

Ready to begin the qualification process now? Start the process with a short 10 minute conversation with an OnCentive expert: (855) 566-0829 or schedule a call.

Have Questions or Need More Information?

<script type=" text=""/>

<script type=" text=""/>