R&D Grant vs. Tax Credit

Helping fund your Research & Development efforts through claiming the R&D Tax credit may be more strategic for your business.

The Research and Development (R&D) Tax Credit is a $18B government incentive offered to companies who create or improve products or processes in the course of their business. And there is no limit on how much you can claim.

When it comes to funding innovation and driving technological advancements, businesses often explore options like grants and tax incentives. However, for those seeking financial support for their research and development endeavors, the R&D Tax Credit stands out as a compelling choice. Unlike grants that come with rigorous application processes, highly competitive pools, and many stipulations and restrictions, the R&D Tax Credit offers a more accessible and predictable route to secure funds.

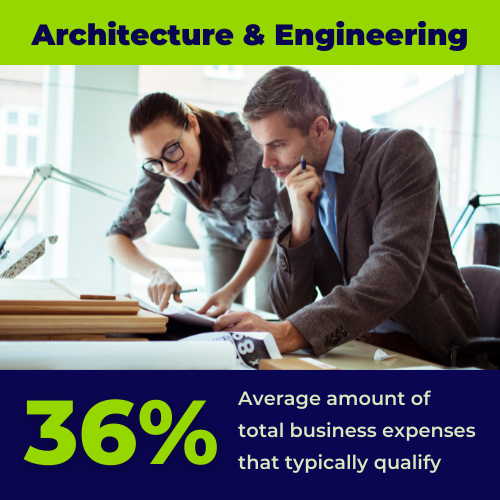

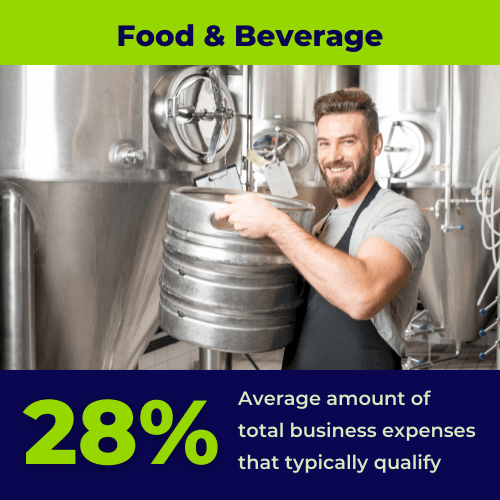

By claiming the credit, eligible businesses can offset a significant portion of their qualified research expenses, including wages, supplies, and contract research costs. This not only aids in reducing tax liabilities but also facilitates a continuous cycle of innovation by freeing up valuable resources that can be reinvested back into R&D initiatives. Additionally, the R&D Tax Credit is not limited to specific industries, allowing a broader range of companies to leverage its benefits, regardless of their size or field of operation.

Use Against Income Tax

You can match the credit against income tax dollar for dollar.

No Limit on How Much You Can Claim

Help your growth business grow with no limits on how much you claim.

Carries Forward for Future Growth

The tax credit carries forward for 20 years and you receive money every year you are eligible.

The Federal R&D tax credit is available to US businesses that develop or improve new products, processes, software, formulas, or business components. Additionally, over 30 states offer R&D credits to offset state tax liability.

R&D Tax Credits increase your profitability by reducing, current and future years’ federal tax liability and creating a ready source of cash for furthering innovation and growing your business. These credits provide a dollar-for-dollar offset against taxes owed or paid, which differs from a deduction.

Despite originally only applying to a few highly technical companies, the R&D Tax Credit was made permanent by the PATH ACT of 2015 and the definition of the credit expanded, allowing a wider range of businesses and industries to qualify for this significant valuable federal tax credit.

$250,000

POTENTIAL CASH SAVINGS PER YEAR AGAINST FEDERAL FICA PAYROLL TAXES

$14.8B

IN R&D CREDITS

CLAIMED ANNUALLY

42%

OF R&D CREDITS CLAIMED ARE BUSINESSES WITH LESS THAN $5 MILLION IN REVENUE

The innovations your company is working on may be eligible for lucrative tax credits.

If your company is creating new products, or improving existing products or processes, there is a strong likelihood you are eligible for the R&D Tax Credit.

In addition to the federal credit, many states offer tax incentives for companies pursuing innovation within their industry. Pre-revenue companies and start-ups with less than five years of revenue can use the federal R&D tax credits to offset future payroll taxes.

OnCentive's team of credit experts, CPAs, and tax lawyers can help your business explore your Research & Development eligibility. At Oncentive, we work on a flexible value-based fee structure where many times no fees are due until our R&D analysis is completed. We offer complete audit support and a money-back guarantee.

FAQ: Research & Development Tax Credit

Not Sure If You Qualify?

Our Experts Determine Your Eligibility For Free.

We understand that understanding and applying for the R&D Tax Credit may feel daunting. The important thing to remember is that you won’t be alone. OnCentive tax credit experts will be there with you every step of the way, to walk you through the process and help you prepare all the necessary documentation.

A 15-minute call can qualify you for the largest tax credit for US businesses.

Or call 219-413-3406

<script type=" text=""/>

<script type=" text=""/>